You’ve done the steps, you think you’re ready to go, so what types of investments are out there for the DIY investor?

I’ve spent the past few posts untangling the basics of investing for freelancers and self-employed creatives, I’ve already discussed what investment is and why you should bother and how to get ready to invest. This time, let’s look at some different types of investments.

There’s an overwhelming variety of things you can buy that are branded investments, either by others or ourselves. However, people are often overly optimistic when it comes to defining what is an investment.

As a working musician, for instance, you might tell yourself that the vintage amplifier you found on eBay is ‘an investment’, when in reality it’s mostly an electrocution risk.

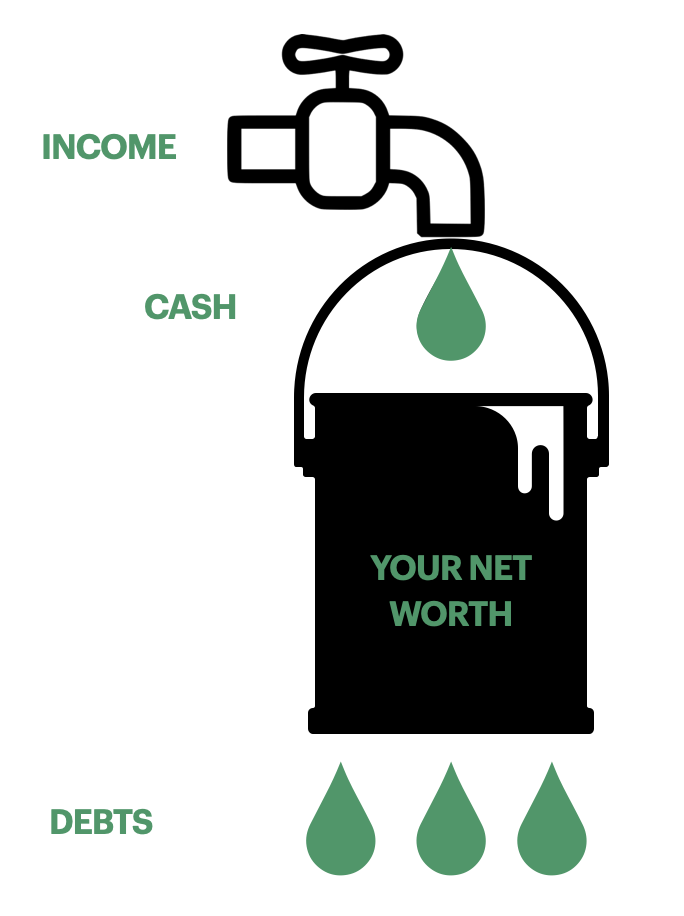

If you have to spend more money on something than it generates, then it’s a liability – not an asset.

You’ll probably have to get the power adapted for the UK, get it repaired every other gig and pay a painful amount to insure it. This is all fine, if you love it and it helps you creatively, but it doesn’t make it an investment.

In fact, if you have to spend more money on something than it generates, then it’s actually a liability – not an asset. Getting your financial life in good shape depends on decreasing your liabilities and increasing your assets (things that put money into your pocket).

Disclaimer: This article is for financial information and education purposes only. It is not financial advice. Investing carries risks. The value of your investments and can go down as well as up and you may not get back the original amount invested. Always do your own research and seek independent advice where required. Read the full disclaimer here.

A class system

So what are some examples of more useful assets?

Assets are varied and numerous, so it can be helpful to think about broader groups or types of assets. Because money-people like to be fancy, and elitist, these groups of asset types are usually referred to as ‘asset classes’.

Three of the main types (or classes) of assets that might fit the definition above are stocks/shares, bonds and property. Let’s look at each of those in more detail…

Want to make sure you never miss a post?

Sign up to the Creative Money newsletter!

Let me read it first >

1. Stocks and shares

When you purchase a share, you’re actually purchasing a tiny slice of a company. In return for your investment, you gain the right to a share of that firm’s current or future profits (the dividend).

As the fortunes of different companies, sectors and entire markets rise and fall, so does the value of their shares.

When you purchase a share, you’re buying a tiny slice of a company.

This is because investors are anticipating better or worse dividend returns as a result of these changes and therefore considering it to be more or less desirable to hold related stocks.

This process is not always rational, of course. All sorts of things create and influence these changes in share prices, which makes them very volatile in the short-term.

The upside: if you invest directly, you get to pick exactly where your money goes and which firms you invest in. Stocks can usually be sold quickly.

The downside: very few individuals are able to accurately predict these changes and consistently make good stock picks.

Mutual funds

A common way to invest in the stock market is through mutual funds. These collect the money of many investors together and use it to buy shares in many companies.

Small investors can then purchase shares in the funds and the fund manager runs the investments, deciding what, when and how much to buy and sell of the investments in the fund’s portfolio.

People describe this type of fund management as ‘active’, because a human being (the fund manager) is actively picking the stocks and deciding .

The upside:

- Benefit from the fund manager’s expertise.

- You can invest in many companies at once, diversifying your investment.

- Huge variety of mutual funds available.

The downside:

- Over time, many active fund managers do not outperform the market (i.e. do better than the average performance of the market as a whole).

- Higher fees to cover the administrative costs and (typically large) salaries and bonuses of the fund managers.

Index funds

Another option is to invest in index funds. Like mutual funds these simultaneously invest many investors money in a collection of stocks, but this time they reflect a defined market or ‘index’ (for instance, the US S&P500 – the 500 biggest firms in the US). You invest in the fund and every pound is split proportionately across all the firms in the fund.

There are index funds tracking all sorts of indices, from the FTSE100 (UK’s biggest firms) to globally diversified ESG (Ethical Social Governance) focussed funds, which aim to only invest in companies that fit a certain ethical criteria.

The upside:

- Diversifies your investment (reducing the risks of investing as returns are not dependent on the fortunes of just a few firms).

- Enables small investors to quickly purchase the shares of many firms at once.

- Lower fees as the funds do not require active management.

- Over time, the market can often outperform many actively managed funds.

The downside:

- You have less influence over the companies you invest in.

- Your money may be invested in firms that are not aligned with your values.

Financial markets as whole typically tend to rise in value over the longterm and the longer you invest for, the more likely it is that this will be the case. Another compelling reason to start investing earlier rather than later.

Overall, stocks and shares (AKA equities) are considered higher risk than the likes of bonds, but have the benefit of offering much higher potential returns over the longterm.

2. Bonds

Want to lend money to a company or government?

Bonds are essentially certificates of debt issued by companies or governments. If you buy a newly issued bond you are lending your money to that institution, usually in return for a certain amount of interest and the promise that the debt will be repaid by a certain date.

Many investors switch to less risky options, like bonds in their later years

They typically offer more predictable and reliable returns than stocks. However, the interest rates (and therefore returns) are low compared with the potential rewards from stock investing.

Many investors like to take on a more risk-heavy approach when they’re young and have more time to recover potential losses, but will switch to less risky options, like bonds in later years, as they near retirement or want more stability.

The upside:

- Lower risk – typically more predictable and reliable returns.

- A useful asset class for those nearing retirement age.

- Can be used to balance risk (e.g. creating a mixed portfolio of stocks and bonds).

The downside:

- Low returns make it extremely difficult for most to reach their financial goals purely with bonds.

3. Property

While our own houses might not be assets day-to-day, There are lots of ways to invest in property. Figuring out the right strategy for your circumstances is key.

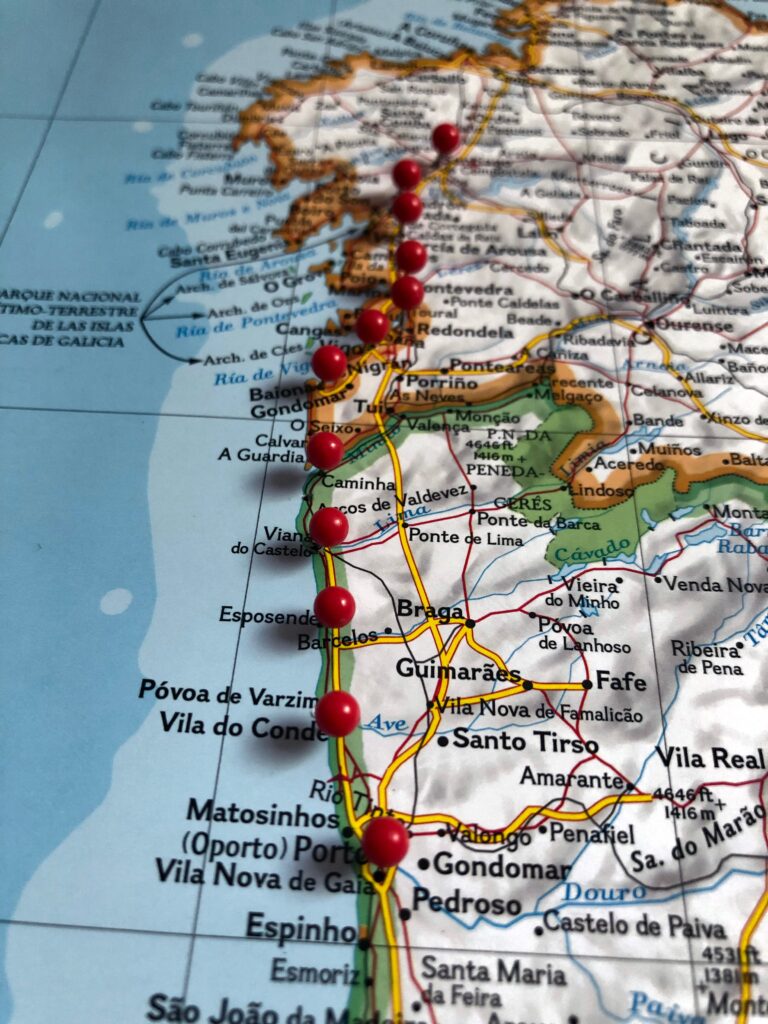

You can purchase a run-down flat, fix it up and try to sell it at a profit straight away (‘a flip’). You can buy houses or flats and rent them out to tenants, focussing on rental income. Or you could invest in a creating a holiday let and focus on short-term, seasonal rentals.

There are lots of ways to invest in property. Figuring out the right strategy for your circumstances is key.

Alternatively, one option for those without a large cash deposit or the inclination to run their own property empire is to invest indirectly via a Real Estate Investment Trust (REIT), which acts a bit like a mutual fund – pooling money from many investors into a managed fund that purchases property.

The upside:

- Property prices tend to rise over time.

- Variety of strategies for different needs (e.g. investing for regular income or intensive renovations for fast returns)

- Can create a source of regular income.

- Property prices have increased rapidly in recent decades.

- Different strategies to suit different investors.

The downside:

- Often requires a large amount of money for a deposit.

- Your money is tied-up in the investment for a long time.

- Selling property can be a laborious process.

- Reliant on finding the right tenants.

- You have to spend time researching and managing the properties (or pay someone else to do it).

There is a bit of a long-running mania around property in the UK, so be careful not to get caught up in the rhetoric and, as ever in investing, always do your own research.

Don’t panic! The perfect investment does not exist

With all of these asset classes, you invest in the hope that they will produce income and/or rise in value before you wish to sell them. However, no investment is perfect. As you can see, each of these types of investment or asset classes carries its own risks.

Knowing that the perfect investment does not exist is a liberating thought. We simply cannot get everything right every time.

Reading all of this for the first time, it can feel like a lot to consume and be tempting to put the whole thing off and avoid it all together.

However, knowing that the perfect investment does not exist is also quite a liberating thought. We simply cannot get everything right every time.

Instead, we need to think about what we’re comfortable with: in terms of the amounts we invest, our knowledge of the investments we’re buying and the risks associated with the assets we buy.

In the posts that follow, then, I’m going to look at some of the ways to manage risk when investing, untangle some of the main investment wrappers (ISAs and pensions) and discuss how to actually go about purchasing investments (this is coming last for a reason!)