Keeping track of your personal finances can be confusing and painful, so let’s try to layout a path that’s easy to follow

The problem with money is that it’s everywhere. It is in your fridge. Your shoes. Your education. The very screen you are reading this on. It is zapping from your smartphone in myriad micro transactions. Amid this endless swirl of decimal points, it’s really easy to lose yourself in the details and miss the bigger picture.

You know the drill: we think nothing of buying lunch at work or university, but don’t start a pension. We stress daily about our fluctuating incomes, but do not set aside cash when it does come in.

We might even spend some time beating ourselves up about this. But none of this is your fault. You are not bad with money. Rather, as a quirk of evolution, the human brain is just not wired to deal with this stuff.

“Everyone has their own priorities in life, but there are some principles that apply no matter who we are”

Our brains are capable of a lot, but at our deepest level of mental programming, we think we are still hunter gatherers. As creative freelancers in 2020, that means we mostly hunt for work and gather sandwiches. We are trained to acquire and quickly consume the things we need because, historically, the things we need have been perishable.

However, the perishable items we need are now easy to acquire. We do not need to down a mammoth before we can make dinner. Money is not something we can directly physically consume and it is usually intangible, meaning our brain’s default position is to file these things away in our bulging ‘stuff to deal with later’ folder.

Map it out

In order to tread a better path for the longer term, it helps to use a map. Everyone has their own priorities in life, of course, so these maps will vary for us all, particularly as creative workers, but some principles apply no matter who we are. These are what I call (in annoying-but-catchy blog parlance) the five stupidly simple steps to financial freedom.

These steps are…

- Spend less than you earn

- Save the difference

- Pay-off debt

- Build an emergency fund

- Invest to support your goals in life

They are simple ideas, but they have huge pay-offs. Making ourselves conscious of these steps, periodically checking the map and taking some action to progress along the route, stops us from getting lost, or worse, into debt cycles or nasty financial outcomes.

Below, I’ve broken down each step and listed some of the resources you can work through that might help you with each stage.

Take it a step at a time. Bookmark this page and return to as and when you can. I don’t expect anyone to digest it all and fix their problems overnight, so don’t expect that of yourself, either!

Nor is this an exhaustive list (yet!), this page will act as a bit of a hub and I will update it as I get more relevant material on the site.

Want to make sure you never miss a post?

Sign up to the Creative Money newsletter!

Let me read it first >

What if I don’t do this stuff?

If you’ve got this far in life without thinking about these steps, again, I get it. We’re all here because we want to make our living from creative work, not sweating over spreadsheets.

The issue is that money problems absolutely will raise their head at some point in your life and if you’re not prepared for them, the outcomes are not good.

The upside to following these steps is huge. The potential downside that comes from ignoring them is far, far greater

At the milder end, you could wind-up forced-out of your industry, missing out on personal and professional opportunities, or ruining your parents’ retirement.

However, it’s also not uncommon to face spiralling mental health problems (the link between money and mental health is well-established, while depression is three times more likely among creative workers), relationship issues (money worries are the biggest cause of divorce) or even homelessness.

Even if you’re confident that someone will bail you out, how long will that be the case? And how long will you feel comfortable taking that support?

The upside to following these steps is huge. The potential downside that comes from ignoring them is far, far greater.

Most of us would agree that the hour or so a month it will take you to avoid these outcomes feels entirely worth it when you consider it in this context. What’s more, that time will help you to not just avoid that pain, but very likely give you a disproportionate return in terms of improving your longterm happiness.

Here we go, then, the five steps…

1. Spend less than you earn

If you take away one principle from this post, or indeed this entire site, make it this one.

Cracking this is key to the whole thing. Consistently spend less than you earn and you can make horrible investments, blow your life’s savings at the roulette table and still likely come out ahead of over half the population of the US.

How do I do this?

You have two methods at your disposal: it’s all about reducing your spending and increasing your income.

Reduce your spending

- Track and review your spending – this doesn’t have to be hard. Get one of the best budgeting apps for UK creative workers and let a robot do the maths. Here’s how I keep track of money in roughly 30 minutes a month.

- Identify the causes of your spending – once you know where it’s going, ask yourself what you are trying to achieve with your spending. Can you come up with a trade-off that doesn’t feel like prohibition? The big longterm wins are usually to be found in your accommodation, transport and food costs but you can make a start right away looking at your day-to-day spending.

- Spend in a way that maximises your happiness – have you got a better idea what to do with it?

Boost your income

- Monetise your hobbies – like a Lily Canter does with her side hustle as a running coach

- Diversify your skillsets – DJ/producer Shell Zenner kept her day job in a different industry for several years and even now has a wide variety of music roles

- Create new income streams – if you’re an artist of creator with a following, look at fan funding options: How does Patreon work for artists and creators?

- Get a mentor – they can help you figure out your worth, set rates and make new contacts in your industry. See Mentoring and the creative industries: how can a mentor help you? for more and sign-up the Creative Money newsletter to stay up-to-date with current mentoring schemes.

- Accept that sometimes you just have to work – sometimes it’s a case of ‘any port in a storm’. Electronic music pioneer Stephen Mallinder made this point very eloquently.

2. Save the difference

We often tell ourselves that building savings is a process of rigorous, joyless discipline. However, thinking in those terms is really unhelpful.

Instead, think about how you can make it easy for yourself to do the right thing. For me, I’ve associated a savings habit with some fairly motivating, positive ideas: mainly the freedom to turn down work I don’t like and the desire to comfortably sustain myself in the down times associated with freelance/creative work.

How do I do this?

- Just make a start – remember any savings are better than no savings. The main thing is to get used to getting that money out of your current account (where it might easily be spent) and putting it to better use elsewhere. You might find this piece How to start saving (when you don’t think you can) helpful here.

- Know why you’re saving – a deep, personal motivation can make a huge difference to your ability to start saving some cash. Some people want an emergency fund (see below), but sometimes reframing it as ‘the freedom fund’, or ‘the f***-off fund’ can really help. This piece from The Billfold lays out a compelling case for having a f***-off fund.

3. Pay-off debt

If you’re in high interest debt, redirect the money you’ve started saving towards repayments. Treat this as a priority – and I mean a genuine priority.

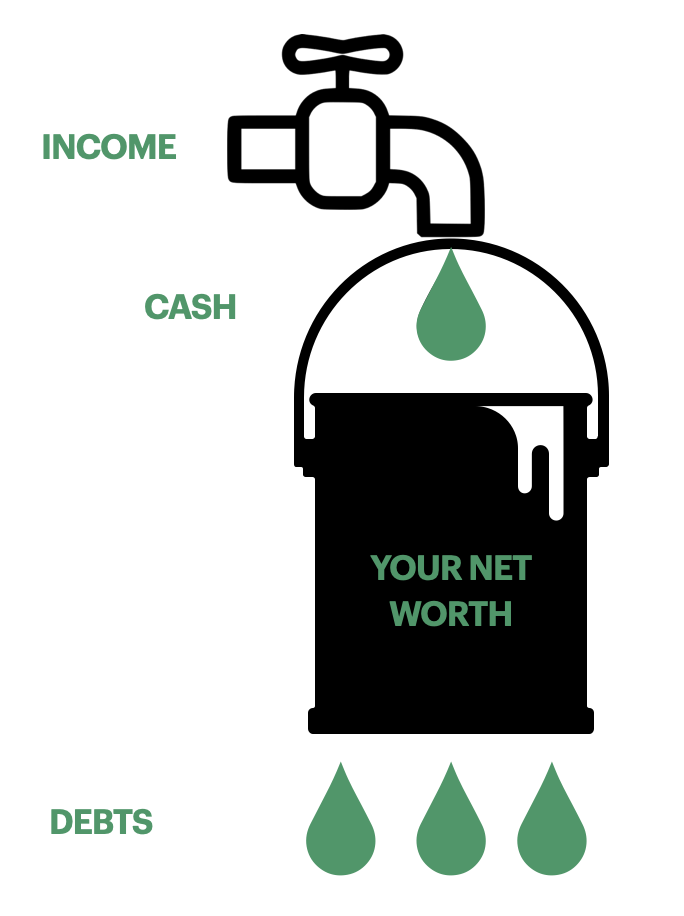

Think about your wealth as water in a bucket. Most of us in creative work have little desire for infinite wealth, but we do want to raise the water level in that bucket to a point where we have a sense of freedom and security.

In this instance, our income is like the tap, sometimes flowing fast, sometimes slowly. However, each debt is a hole in that bucket and if you’re paying interest on those debts, then not only are you losing water, but each of those holes is growing bigger every day. The sooner you act the easier it is plug the holes.

Ignore them, though, and they will grow to the point where the bottom drops out. That looks like bankruptcy, homelessness, relationship breakdown and other things that we very much do not want in our lives.

The excellent US blogger, Mr Money Mustache says you should treat high interest debt as an emergency – as if “your hair is on fire”, so hurl everything you’ve got at it.

How do I do this?

- Move high interest debts to lower interest accounts (e.g. a 17.9% interest credit card to a 0% balance transfer card) – this will slow the growth of the debt and mean you can direct more to the actual repayment.

- Focus on paying off the highest interest debt – Make minimum payments on the others, when that’s paid off, roll the same payment amount over to the next highest interest debt and so on. This is the time to tighten the belt, maximise that gap between your earnings and spending and funnel everything you can to the debt.

- Struggle with motivation? Try Dave Ramsey’s ‘debt snowball’ technique – This approach asks you to order your debts by total owed and pay off the smallest one first, then roll all the payments over to the next smallest and so on. Some people find that clearing those first few small debts is really motivating. One caveat is that it is usually not the best option mathematically, because it can leave you paying more in interest.

- Learn to differentiate between good debt and bad debt – not all debts are equal. Taking on a mortgage for the right property might represent a great investment, while racking-up high costs debts on a Buy Now, Pay Later service (Klarna etc.), or putting pints on a credit card, are signs you’re taking on bad debt. These are the ones to jump on ASAP and avoid in the future.

4. Build an emergency fund

Everyone should have an emergency fund, but if you’re a freelancer or on a variable income (like the majority of creative workers) you absolutely need one.

There is a reason that all good financial advisors and personal finance experts recommend this: you can’t predict what an emergency will look like or when it will come, but it will happen.

Vehicles breakdown. Technology turns on you hours before a show starts. Things get lost or stolen on tour. A work or personal relationship sours suddenly. Houses flood or go on fire. There’s a bloody great pandemic and all work dries up. You get the picture.

How do I do this?

- Pick an achievable target – the common advice, and I think it’s solid, is to save £1,000 or a month’s expenses. If things go well with that goal, you can then build that up to three to six months expenses over time.

- Keep it somewhere accessible – not in a shoe box, but in a savings account that you can reach with a few hours or at most a few days notice. You will earn horrible interest on it. Accept this.

- Do not skip this step – some people think they can do without the emergency fund and move on to the fun ‘make me money’ investment stuff. I have totally tried this approach and am here to tell you it totally does not work out. If the investment drops at the same time as an emergency expense* you are forced to withdraw your money at a point when it’s worth less than you paid-in.

*Finances seem to operate on a ‘Sod’s law’ basis, so if you gamble that it won’t happen, it probably will…

5. Invest to support your goals in life

Most people who have built their own wealth have done so via investing or creating businesses. It’s very, very difficult for most of us to simply save our way there.

Investing is the process of buying assets – things that hold some value and can be expected to produce an income (for instance, stocks and shares, which pay a share of a company’s profits, or a property which pays you rental income). In other words: putting the money you save to work making more money.

If you’re not in love with the idea of investing, the trick is to pick something you understand and keep it simple. I have not covered investments on this site yet as I’ve been focussing on some of the previous steps in this list. This will change in the future, but for now here are some key pointers…

How do I do this?

- Get going ASAP – the hackneyed phrase in financial circles is that “the best time to invest was 10 years ago, the second best time is today”. This is annoying but also true. As soon as you’ve got debts in hand and some emergency savings, direct that cash to investments.

- Start a pension – there is a pensions crisis looming in the creative industries and it’s going to hurt a lot of people. Only 24% of the self-employed save into a pension. The current UK state pension is just £134 a week and likely to fall in real terms over the coming decades. If you don’t have a workplace pension with a company, consider opening a SIPP (Self-Invested Personal Pension). Any amount on top of that state pension is better than no amount. What’s more, even if you’re self-employed, the government will automatically top up your payments by 20% in the form of tax relief, meaning that if you pay in £100 it becomes £120 – and that’s before any return from the investments you put it in. Don’t miss out on that.

- Diversify your investments – it’s a very good idea to spread the risk of your investments, so that if things don’t work out then you’re not at the mercy of one market or firm. For this reason, it might be wise to invest in whole markets via low cost index funds (in which you buy a single fund which automatically invests your cash into a small share of every company in the index or stock exchange of your choice). Have a look at Alan Donegan’s guide to index funds. It’s really not hard to get set-up.

- Invest for the long-term – if you invest in stocks and shares, think long-term – like 10 years plus. You’re not locking that money away forever and (if you use something like a Stocks & Shares ISA) you can often access it within a few days if need be, but leaving it in there for the long term gives you a far better chance of a decent return. The stock market fluctuates wildly day-to-day, which is why picking individual stocks and so called ‘day trading’ is tantamount to gambling for most. However, it almost always goes up over the long term.

Acknowledgements

The thinking in this piece has been heavily influenced by a number of financial gurus.

Dave Ramsey we owe for the debt snowball and his renowned concept of the seven ‘Baby steps’, some of which has filtered through here (I don’t agree with it all). Mr Money Mustache continues to influence a lot of my thinking about saving, dealing with debt and investing. Alan and Katie Donegan’s Take Control Of Your Finances course was also really helpful to me in terms of simplifying this overall journey. They were both very generous with their time and humour. They deserve much praise and Mars bars.

Disclaimer

The information does not constitute financial advice or recommendation and should not be considered as such. Creative Money is not regulated by the Financial Conduct Authority (FCA), its authors are not financial advisors and are therefore not authorised to offer financial advice.

Investing carries risks – the value of investments and any income derived from them can fall as well as rise and you may not get back the original amount you invested. Always do your own research and seek independent financial advice where required.